Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

U308 report...

Uranium Price Gap Widens

http://uraniuminvestingnews.com/11849/uranium-price-gap-widens.html

Tuesday July 3, 2012, 1:09pm PDT IBTimes reported June was a slow month in uranium as the yellowcake remained largely untraded and the gap between buyers and sellers widened.

As quoted in the market news:

“Spot prices barely budged on the 15 transactions reported in June by industry consultant TradeTech, with sellers unwilling to drop their prices and buyers not willing to pay more.

With traders comprising the vast majority of both buyers and sellers in the bulk of the transactions reported over the past several months, TradeTech notes the spot uranium price remains stuck between the lack of committed buyers and what are fairly unmotivated sellers at current levels.

Strong possibility of a market bottom... link to comps:

http://stockcharts.com/freecharts/candleglance.html?USU,URRE,URG,URZ,EFR.TO,DNN,UEC,URPTF,MGAFF,SXRZF,CXZ,RRI.V|C|H14,3

U308: Oil Prices Rose 19% In 2011 - Another Sign That A Nuclear Renaissance Is Inevitable

January 3, 2012

http://seekingalpha.com/article/317065-oil-prices-rose-19-in-2011-another-sign-that-a-nuclear-renaissance-is-inevitable

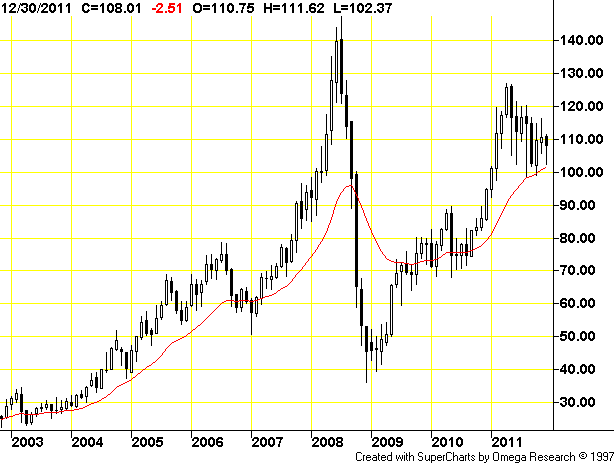

Oil prices rose 19% over the course of 2011, the third consecutive year marked by a rise in the price of oil. Below is the monthly chart of Brent Crude Oil that illustrates the clear uptrend.

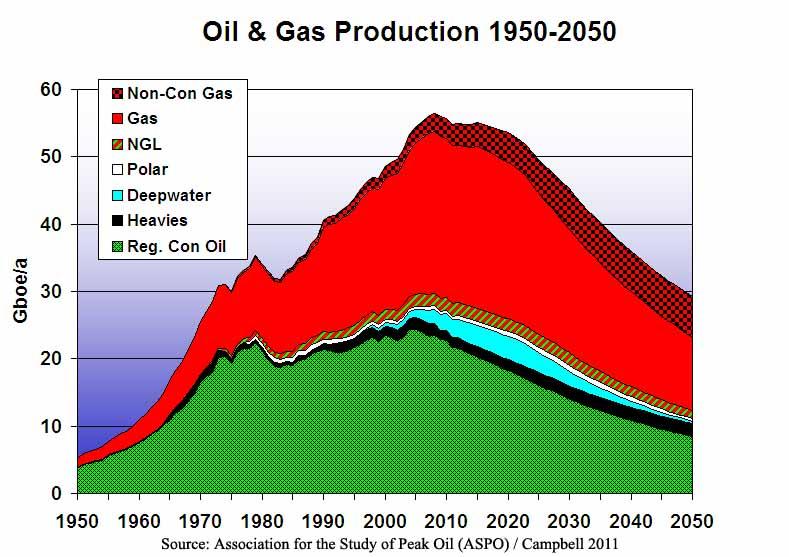

While currency devaluation, geopolitical tensions, and speculators are all forces that may be contributing to rising oil prices and greater market volatility, a growing factor that suggests the price rise will continue is the supply/demand imbalance in the oil market. In other words: demand for oil and other fossil fuels is only growing, but the supply of them is diminishing. The chart below illustrates.

While I believe the world will likely be using fossil fuels as a primary source of energy for some time, we are clearly at a point where a new source of energy is needed. I believe nuclear energy is the primary candidate destined to grow, for the following reasons:

1. It can provide "baseload" - meaning always on - energy

2. It is emission-free

3. It has high power density, which means it does not require an inordinate amount of land and thus is conducive to powering cities

4. It is inexpensive

No other source can really make these same claims. Wind and solar are much more expensive and cannot effectively provide baseload energy, which is precisely why they remain insignificant sources of power on a global basis. Technological breakthroughs may change this, though I don't see this on the horizon, and believe renewables will have limited roles in the global energy market until this changes.

And so, the rise of nuclear energy is virtually inevitable -- the world will demand it for survival. Accordingly, China already has 25 nuclear power plants under construction, and realizes that nuclear will be a key part of how its nation is powered as it increasingly urbanizes. Investors can recognize China as the "smart money" -- the force driving the market's demand and sending prices higher -- in the nuclear energy market.

Of course, this transition will not occur overnight - nuclear power plants take a long time to build - and so oil, coal, and natural gas will continue to play an important role in providing energy to the world. Investors will need to be patient, as this market may take up to a decade to really get going. The value network is still developing and much depends on how government participates and regulates the market, as well as what innovations entrepreneurs will develop as the market grows.

For now, the investment opportunity is simple: uranium. Nuclear power is most easily obtained through processing of uranium, and so uranium mining firms are the buy and hold opportunity for patient investors looking to participate in the nuclear renaissance. Uranium ETFs like URA as well as mining companies like Uranerz (URZ), Uranium Energy Corporation (UEC), and Cameco (CCJ) are plays that make sense from this perspective, with UEC being my favorite due to the adept leadership of its Amir Adnani - its founder and CEO with a background as a serial entrepreneur with a marketing focus - as well as the firm's focus on ISR mining which I regard as an enabling technology that will allow UEC to experience lower mining costs than traditional open pit mines.

As compelling as the uranium story is, I cannot overemphasize the need for patience. Nuclear energy is still not appreciated and the entire energy market is poorly understood. This represents a great opportunity for the educated investor, provided they have patience and conviction, and understand the economics of nuclear is really the only option barring some type of technological breakthrough that currently is nowhere in sight. As always, investors will find it to their advantage to focus on the actions of the smart money - which in this case is China - while ignoring short-term sentiment factors like the concerns about nuclear energy stemming from the Fukushima crisis.

While uranium remains the mineral to invest in and focus on, investors should also keep an eye out to see how Thorium develops. Thorium is a potential substitute for uranium in the production of nuclear power, and possesses less of a radiation risk - a common criticism of uranium. However, the value network for thorium is a bit undeveloped at the moment, and it does not appear that there is yet a "smart money" faction that can push prices higher. Thorium is also more a more expensive way of generating nuclear power, an obstacle I suspect will need to be overcome if thorium is to become a serious opportunity for investors looking to invest in the nuclear renaissance.

So get ready for a whole new energy paradigm as we move away from oil. Understand, though, the process will take time, and that the science and economics suggest the opportunity is nuclear energy unless there is some type of a big technological breakthrough. And of course, patience is your friend; while the economics will, as always, ultimately dictate what happens, the process can be slow. China is the one to watch, and so long as they are committed to the market, any sell-offs in opportunities to invest in nuclear energy, namely via uranium mining firms, constitute an opportunity to buy the dip.

Disclosure: I am long UEC, CCJ.

What's new: Canada reaches uranium trade deal with China

Thu Feb 9, 2012 10:16am EST

* Pact allows more Canadian uranium into China

* China fastest growing nuclear market in world

* Uranium to be used for civilian nuclear program

http://www.reuters.com/article/2012/02/09/canada-china-uranium-idUSL2E8D94O520120209

BEIJING, Feb 9 (Reuters) - Canada has reached a deal with China that will make it easier for Cameco Corp and other Canadian uranium producers to sell nuclear fuel into the fastest-growing market for atomic power.

The trade deal, announced on Thursday during Prime Minister Stephen Harper's visit to China, allows Cameco - the largest publicly listed producer - to sell uranium from its Canadian projects into China. Details of the agreement were not provided.

"This agreement will help Canadian uranium companies to substantially increase exports to China, the world's fastest growing market for these products," Harper's office said in a statement.

China currently operates some 13 nuclear reactors, with a total nuclear power output of about 11 gigawatts. The Asian country, which has 27 reactors under construction, plans to boost output to 80 gigawatts by 2020.

By contrast, the United States has 104 nuclear reactors.

Construction of reactors in China is expected to outweigh the decommissioning of plants in Japan, where reactors were taken offline in the wake of the Fukushima disaster last March, and in Germany, where the Japanese disaster led to a policy shift away from nuclear power.

In 2010, Cameco signed two deals with China to provide the country more than 50 million pounds of uranium over 15 years. Cameco has major uranium projects in Canada, the United States, Kazakhstan and Australia.

"We couldn't deliver Canadian uranium here until this agreement was signed so it opened the door for us to do that," said Chief Executive Tim Gitzel, who is part of a trade delegation visiting China this week with the Canadian prime minister.

Canada and China are working to finalize the text of the agreement and expect it to be completed within the next few months, according to the release.

Saskatoon, Saskatchewan-based Cameco, which will report its fourth-quarter earnings after market close on Thursday, plans to boost its uranium production to 40 million pounds a year by 2018.

Scoreboard for the week: +17.42%

Here goes the U308 sector!!! Charted comparables:

http://stockcharts.com/freecharts/candleglance.html?USU,URRE,URG,URZ,PUC.V,ATURF,DNN,UEC,URPTF,MGAFF|B|H14,3

Still struggling to hold those gains...

The sector is reversing upward...

$2 held but no rebound either...

Is this going to break $2???

Confirmation release from DOE:

From the DOE: April 15, 2011

Dr. Peter B. Lyons Confirmed as Assistant Secretary for Nuclear Energy

http://www.energy.gov/news/10269.htm

Washington, D.C. - Dr. Peter B. Lyons was confirmed by the Senate on Thursday, April 14, as the Department of Energy's Assistant Secretary for Nuclear Energy.

"Pete Lyons' depth of expertise and experience make him uniquely qualified for this role, and I am confident he will continue to serve the Department, the President and the Nation with distinction," said Energy Secretary Steven Chu. "I applaud the Senate for quickly taking action to approve his nomination, and I look forward to our work together to ensure that safe nuclear power plays an important role in America's clean energy future."

As Assistant Secretary for Nuclear Energy, Dr. Lyons will serve as the primary policy advisor to the Secretary of Energy and the Department on key issues involving nuclear energy research, development and demonstration, as well as international nuclear activities. His responsibilities will include managing Federal programs aimed at fulfilling the potential of nuclear power as a major contributor in meeting our Nation's energy supply, environmental and energy security needs.

Before his Senate confirmation to his new position, Dr. Lyons served as the Acting Assistant Secretary for Nuclear Energy since November 2010, and as the Principal Deputy Assistant Secretary of the Office of Nuclear Energy at the Department of Energy (2009-2010). Prior to this appointment, Dr. Lyons served as a Commissioner of the Nuclear Regulatory Commission from 2005 until his term ended in 2009. From 2003 to 2005, Dr. Lyons served as Science Advisor on the staff of U.S. Senator Pete Domenici and the Senate Committee on Energy and Natural Resources, where he focused on military and civilian uses of nuclear technology, national science policy, and nuclear non-proliferation.

From 1997 to 2003, Dr. Lyons was assigned by the Los Alamos National Laboratory to serve as Science Advisor on the staff of U.S. Senator Pete Domenici and the Senate Energy and Natural Resources Committee, where he focused on military and civilian uses of nuclear technology, national science policy, and nuclear non-proliferation. From 1969 to 1996, Dr. Lyons held several positions at the Los Alamos National Laboratory including: Director for Industrial Partnerships, Deputy Associate Director for Energy and Environment, and Deputy Associate Director-Defense Research and Applications.

Dr. Lyons has published more than 100 technical papers, holds three patents related to fiber optics and plasma diagnostics, and served as chairman of the NATO Nuclear Effects Task Group for five years. Dr. Lyons is a Fellow of both the American Nuclear Society and the American Physical Society. He received his Ph.D. in Nuclear Astrophysics from the California Institute of Technology (1969) and his undergraduate degree in Physics and Mathematics from the University of Arizona (1964).

-3.83% is the scorecard for the week...

US Nuclear Regulators To Vote On Proposal To Review Japan Crisis, Assess US Safety

Date : 03/21/2011 @ 12:21PM

Source : Dow Jones News

http://ih.advfn.com/p.php?pid=nmona&article=46958493

The U.S. Nuclear Regulatory Commission is expected to vote today on a proposal that directs nuclear officials to conduct a 90-day review of events at Japan's Fukushima power plant and to identify potential new rules for the U.S. nuclear industry.

This 90-day review marks one of the first formal steps taken by the commission to digest incoming information on the Japanese nuclear crisis and to determine whether the U.S. needs to adopt new standards at its own facilities as a result.

In the meantime, the Nuclear Regulatory Commission is also conducting "temporary" inspections of the 104 nuclear reactors in the U.S. to assess their ability to respond to severe accidents -- namely, to determine whether they can deal with total losses of power, mitigate problems associated with flooding and deal with equipment losses due to seismic events.

The commission will also outline goals for a longer-term review of the Japanese crisis and the safety of the U.S. industry.

The 90-day review, meanwhile, will include an evaluation of the ability of reactors to respond to station blackouts and severe accidents. It will also involve a radiological consequent analysis, said Bill Borchardt, NRC's executive director for operations.

The review "will evaluate all of the currently available information from the Japanese event and look at it to evaluate our 104 operating reactors' ability to protect against natural disasters," Borchardt said during a briefing Monday.

The NRC's commissioners are expected to vote on the 90-day review proposal today. The proposal should be made public shortly thereafter, an NRC spokesman said.

Within the 30 days of the review, NRC staff will deliver a "quick look" report to the commissioners that outlines the condition of the U.S. fleet of nuclear reactors. "The idea is just to get a quick snapshot," Borchardt said.

Given the time constraints of the 30-day review, Borchardt said the commission will not collaborate with the nuclear industry on its initial quick-look report.

Following both the temporary inspections and the 90-day review, the commission will determine whether it needs to adopt new rules or standards.

The Nuclear Regulatory Commission is also evaluating updated seismic information, from the U.S. Geological Survey, for the central and eastern United States.

As more information about the Japanese nuclear disaster becomes available, the Nuclear Regulatory Commission will conduct a long-term analysis to identify possible areas of future research and potential changes to the reactor oversight program. This review could also lead to new rules.

Borchardt said he did not know when the commission will launch this long-term review but that it will welcome "substantial stakeholder involvement" when it does.

-By Tennille Tracy, Dow Jones Newswires; 202-862-6619; tennille.tracy@dowjones.com

Bullish commentary: In the wake of Japan's nuclear catastrophe, uranium investors have taken it on the chin. Uranium stocks have sold off sharply as radiation fears spread around the world.

The Global X Uranium ETF tumbled -17% last Monday and opened down another -15% on Tuesday.

So what's a uranium investor to do? Is it time to cut and run... or double down?

If I were you, I'd listen to Warren Buffett: "Be fearful when others are greedy and be greedy when others are fearful."

I'm with Warren on this one. This is a major buying opportunity to pick up quality stocks at a discount as nervous investors unload uranium like crazy. Here's why:

This kneejerk reaction is grossly overdone. The iShares Japan index fund is down just -6% since the earthquake yet uranium producers in North America with minimal ties to the situation are down -25% or more. That doesn't make sense.

The ruined reactors consume just 2% of the world's uranium. The other 435 reactors worldwide will be as hungry as ever for uranium, even if Japan scales back its usage.

India and China are still fully on board. China plans to triple the size of its reactor fleet from 13 to 40 over the next decade. India wants 10 times as much nuclear power. That puts steady pressure under uranium prices.

No matter what happens in Japan, nuclear energy is not going away. Think about the BP oil spill in the Gulf of Mexico. Naysayers said there would be a permanent ban on exploration -- but we're drilling again. At the end of the day, our voracious energy needs outweigh the risk of an isolated incident.

As Buffett suggests, it takes guts... but taking stocks off the hands of panicky sellers almost always pays off in the long run.

So I'm a buyer at today's prices. I think uranium stocks will regain all their lost ground and a whole lot more.

Not to mention... there's a looming squeeze on uranium prices coming out of Russia that few people are aware of. When it hits, uranium could go through the roof.

Japan Nuclear Disaster Caps Decades of Faked Reports, Accidents

March 17, 2011, 11:22 AM EDT

By Jason Clenfield

http://www.businessweek.com/news/2011-03-17/japan-nuclear-disaster-caps-decades-of-faked-reports-accidents.html

March 18 (Bloomberg) -- The unfolding disaster at the Fukushima nuclear plant follows decades of falsified safety reports, fatal accidents and underestimated earthquake risk in Japan’s atomic power industry.

The destruction caused by last week’s 9.0 earthquake and tsunami comes less than four years after a 6.8 quake shut the world’s biggest atomic plant, also run by Tokyo Electric Power Co. In 2002 and 2007, revelations the utility had faked repair records forced the resignation of the company’s chairman and president, and a three-week shutdown of all 17 of its reactors.

With almost no oil or gas reserves of its own, nuclear power has been a national priority for Japan since the end of World War II, a conflict the country fought partly to secure oil supplies. Japan has 54 operating nuclear reactors -- more than any other country except the U.S. and France -- to power its industries, pitting economic demands against safety concerns in the world’s most earthquake-prone country.

Nuclear engineers and academics who have worked in Japan’s atomic power industry spoke in interviews of a history of accidents, faked reports and inaction by a succession of Liberal Democratic Party governments that ran Japan for nearly all of the postwar period.

Katsuhiko Ishibashi, a seismology professor at Kobe University, has said Japan’s history of nuclear accidents stems from an overconfidence in plant engineering. In 2006, he resigned from a government panel on reactor safety, saying the review process was rigged and “unscientific.”

Nuclear Earthquake

In an interview in 2007 after Tokyo Electric’s Kashiwazaki nuclear plant was struck by an earthquake, Ishibashi said fundamental improvements were needed in engineering standards for atomic power stations, without which Japan could suffer a catastrophic disaster.

“We didn’t learn anything,” Ishibashi said in a phone interview this week. “Nuclear power is national policy and there’s a real reluctance to scrutinize it.”

To be sure, Japan’s record isn’t the worst. The International Atomic Energy Agency rates nuclear accidents on a scale of zero to seven, with Chernobyl in the former Soviet Union rated seven, the most dangerous. Fukushima, where the steel vessels at the heart of the reactors have so far not ruptured, is currently a class five, the same category as the 1979 partial reactor meltdown at Three Mile Island in the U.S.

‘No Chernobyl’

“The key thing here is that this is not another Chernobyl,” said Ken Brockman, a former director of nuclear installation safety at the IAEA in Vienna. “Containment engineering has been vindicated. What has not been vindicated is the site engineering that put us on a path to accident.”

The 40-year-old Fukushima plant, built in the 1970s when Japan’s first wave of nuclear construction began, stood up to the country’s worst earthquake on record March 11 only to have its power and back-up generators knocked out by the 7-meter tsunami that followed.

Lacking electricity to pump water needed to cool the atomic core, engineers vented radioactive steam into the atmosphere to release pressure, leading to a series of explosions that blew out concrete walls around the reactors.

Radiation readings spiked around Fukushima as the disaster widened, forcing the evacuation of 200,000 people and causing radiation levels to rise on the outskirts of Tokyo, 135 miles (210 kilometers) to the south, with a population of 30 million.

Basement Generator

Back-up diesel generators that might have averted the disaster were positioned in a basement, where they were overwhelmed by waves.

“This in the country that invented the word Tsunami,” said Brockman, who also worked at the U.S. Nuclear Regulatory Commission. “Japan is going to have a look again at its regulatory process and whether it’s intrusive enough.”

The cascade of events at Fukushima had been foretold in a report published in the U.S. two decades ago. The 1990 report by the U.S. Nuclear Regulatory Commission, an independent agency responsible for safety at the country’s power plants, identified earthquake-induced diesel generator failure and power outage leading to failure of cooling systems as one of the “most likely causes” of nuclear accidents from an external event.

While the report was cited in a 2004 statement by Japan’s Nuclear and Industrial Safety Agency, it seems adequate measures to address the risk were not taken by Tokyo Electric, said Jun Tateno, a former researcher at the Japan Atomic Energy Agency and professor at Chuo University.

Accident Foretold

“It’s questionable whether Tokyo Electric really studied the risks,” Tateno said in an interview. “That they weren’t prepared for a once in a thousand year occurrence will not go over as an acceptable excuse.”

Hajime Motojuku, a utility spokesman, said he couldn’t immediately confirm whether the company was aware of the report.

All six boiling water reactors at the Fukushima Dai-Ichi plant were designed by General Electric Co. and the company built the No. 1, 2 and 6 reactors, spokeswoman Emily Caruso said in an e-mail response to questions. The No. 1 reactor went into commercial operation in 1971.

Toshiba Corp. built 3 and 5. Hitachi Ltd., which folded its nuclear operations into a venture with GE known as Hitachi-GE Nuclear Energy Ltd. in 2007, built No. 4.

All the reactors meet the U.S. Nuclear Regulatory Commission requirements for safe operation during and after an earthquake for the areas where they are licensed and sited, GE said on its website.

Botched Container?

Mitsuhiko Tanaka, 67, working as an engineer at Babcock Hitachi K.K., helped design and supervise the manufacture of a $250 million steel pressure vessel for Tokyo Electric in 1975. Today, that vessel holds the fuel rods in the core of the No. 4 reactor at Fukushima’s Dai-Ichi plant, hit by explosion and fire after the tsunami.

Tanaka says the vessel was damaged in the production process. He says he knows because he orchestrated the cover-up. When he brought his accusations to the government more than a decade later, he was ignored, he says.

The accident occurred when Tanaka and his team were strengthening the steel in the pressure vessel, heating it in a furnace to more than 600 degrees Celsius (1,112 degrees Fahrenheit), a temperature that melts metal. Braces that should have been inside the vessel during the blasting were either forgotten or fell over. After it cooled, Tanaka found that its walls had warped.

‘Felt Like a Hero’

The law required the flawed vessel be scrapped, a loss that Tanaka said might have bankrupted the company. Rather than sacrifice years of work and risk the company’s survival, Tanaka used computer modeling to devise a way to reshape the vessel so that no one would know it had been damaged. He did that with Hitachi’s blessings, he said.

“I saved the company billions of yen,” Tanaka said in an interview March 12, the day after the earthquake. Tanaka says he got a 3 million yen bonus ($38,000) from Hitachi and a plaque acknowledging his “extraordinary” effort in 1974. “At the time, I felt like a hero.”

That changed with Chernobyl. Two years after the world’s worst nuclear accident, Tanaka went to the Ministry of Economy, Trade and Industry to report the cover-up he’d engineered more than a decade earlier. Hitachi denied his accusation and the government refused to investigate.

Kenta Takahashi, an official at the NISA’s Power Generation Inspection Division, said he couldn’t confirm whether the agency’s predecessor, the Agency for Natural Resources and Energy, conducted an investigation into Tanaka’s claim.

‘No Safety Problem’

In 1988, Hitachi met with Tanaka to discuss the work he had done to fix the dent in the vessel. They concluded that there was no safety problem, said Hitachi spokesman Yuichi Izumisawa. “We have not revised our view since then,” Izumisawa said.

In 1990, Tanaka wrote a book called “Why Nuclear Power Is Dangerous” that detailed his experiences.

Tokyo Electric in 2002 admitted it had falsified repair reports at nuclear plants for more than two decades. Chairman Hiroshi Araki and President Nobuyama Minami resigned to take responsibility for hundred of occasions on which the company had submitted false data to the regulator.

Then in 2007, the utility said it hadn’t come entirely clean five years earlier. It had concealed at least six emergency stoppages at its Fukushima Dai-Ichi power station and a “critical” reaction at the plant’s No. 3 unit that lasted for seven hours.

Coming Clean

Kansai Electric Power Co., the utility that provides Osaka with electricity, said it also faked nuclear safety records. Chubu Electric Power Co., Tohoku Electric Power Co. and Hokuriku Electric Power Co. said the same.

Only months after that second round of revelations, an earthquake struck a cluster of seven reactors run by Tokyo Electric on Japan’s north coast. The Kashiwazaki Kariwa nuclear plant, the world’s biggest, was hit by a 6.8 magnitude temblor that buckled walls and caused a fire at a transformer. About 1.5 liters (half gallon) of radioactive water sloshed out of a container and ran into the sea through drains because sealing plugs hadn’t been installed.

While there were no deaths from the accident and the IAEA said radiation released was within authorized limits for public health and environmental safety, the damage was such that three of the plant’s reactors are still offline.

After the quake, Trade Minister Akira Amari said regulators hadn’t properly reviewed Tokyo Electric’s geological survey when they approved the site in 1974.

Fault Line

The world’s biggest nuclear power plant had been built on an earthquake fault line that generated three times as much as seismic acceleration, or 606 gals, as it was designed to withstand, the utility said. One gal, a measure of shock effect, represents acceleration of 1 centimeter (0.4 inch) per square second.

After Hokuriku Electric’s Shika nuclear power plant in Ishikawa prefecture was rocked by a 6.9 magnitude quake in March 2007, government scientists found it had been built near an earthquake fault that was more than twice as long as regulators deemed threatening.

“Regulators just rubber-stamp the utilities’ reports,” Takashi Nakata, a former Hiroshima Institute of Technology seismologist and an anti-nuclear activist, said at the time.

While Japan had never suffered a failure comparable to Chernobyl, the Fukushima disaster caps a decade of fatal accidents.

Two workers at a fuel processing plant were killed by radiation exposure in 1999, when they used buckets, instead of the prescribed containers, to eye-ball a uranium mixture, triggering a chain-reaction that went unchecked for 20 hours.

‘No Possibility’

Regulators failed to ensure that safety alarms were installed at the plant run by Sumitomo Metal Mining Co. because they believed there was “no possibility” of a major accident at the facility, according to an analysis by the NRC in the U.S. The report said there were ‘indications’ the company instructed workers to take shortcuts, without regulatory approval.

In 2004, an eruption of super-heated steam from a burst pipe at a reactor run by Kansai Electric killed five workers and scalded six others. A government investigation showed the burst pipe section had been omitted from safety checklists and had not been inspected for the 28 years the plant had been in operation.

Unlike France and the U.S., which have independent regulators, responsibility for keeping Japan’s reactors safe rests with the same body that oversees the effort to increase nuclear power generation: the Trade Ministry. Critics say that creates a conflict of interest that may hamper safety.

‘Scandals and Lies’

“What is necessary is a qualified, well-funded, independent regulator,” said Seth Grae, chief executive officer of Lightbridge Corp., a nuclear consultant in the U.S. “What happens when you have an independent regulatory agency, you can have a utility that has scandals and lies, but the regulator will yank its licensing approvals,” he said.

Tanaka says his book on the experiences he had with the nuclear power industry went out of print in 2000. His publisher called on March 13, two days after the Fukushima earthquake, and said they were starting another print run.

“Maybe this time people will listen,” he said.

--With assistance from Yuriy Humber, Tsuyoshi Inajima, Maki Shiraki and Shigeru Sato in Tokyo, Makiko Kitamura in Osaka and Rachel Layne in Boston. Editors: Peter Langan, Philip Revzin

To contact the reporter on this story: Jason Clenfield in Tokyo at jclenfield@bloomberg.net

To contact the editor responsible for this story: Peter Langan at plangan@bloomberg.net

Down 33% this week on the Japan crisis.

My friends, for the week: +12%!!!

A good informational resource about uranium:

http://en.wikipedia.org/wiki/Uranium

Special Report: Nuclear's lost generation

http://www.reuters.com/article/idUSTRE6AS1PQ20101129?pageNumber=1

By Sylvia Westall

OLKILUOTO, Finland | Mon Nov 29, 2010 8:25am EST

OLKILUOTO, Finland (Reuters) - On a flat, low-lying island nestled in crisp waters off the west coast of Finland, the first nuclear power plant ordered in Western Europe since 1986 is inching toward start-up.

Over 4,000 builders and engineers are at work on the sprawling Olkiluoto 3 project, whose turbine hall is so cavernous it could house two Boeing 747 jets stacked on top of each other.

When it is dark, which in winter is most of the day, enormous spotlights throw into focus scores of scaffolding towers and the red hauling equipment that encircle the grey, unfinished reactor building.

The heavy reactor vessel, made to withstand temperatures over 350 degrees Celsius, has been gingerly lifted into place by two cranes.

Inside the building, a dozen workers carrying a single pipe across their shoulders create a human caterpillar that carefully wends its way through tarpaulin-covered tunnels lit by lamps and chinks of daylight.

Walking through the expansive complex, still missing a domed cover on the reactor building, it takes a while to make out a peculiar but important detail: many of the engineers and building experts working here are in their late 50s and early 60s; some are in their 30s, but few are in between.

There's a hole in the nuclear workforce, not just in Finland but across the Western world. For the moment, the operator of the Olkiluoto 3 plant, power utility Teollisuuden Voima Oyj (TVO), is getting by with its most experienced staff. As those workers retire, though, the skills shortage could become a crisis.

"The nuclear industry has been in the desert for years and years and the question is how to revamp it and how to revamp human resources," says Colette Lewiner from Cap Gemini, a consultancy firm which raised concerns about the aging nuclear workforce in a report in 2008 and has warned "there will be no nuclear power renaissance" without efforts to tackle the problem. "The industry needs to ramp up and it needs to do it quickly."

Like a growing number of nations, Finland sees nuclear power as vital to its future prosperity. Olkiluoto 3 is the biggest investment in the history of Finnish industry. Helsinki wants nuclear power to provide more than a third of the country's electricity by 2020, reducing its dependence on carbon-emitting fossil fuels and energy imports from Russia. Globally, 15 countries are currently building 63 nuclear power plants, according to the International Atomic Energy Agency (IAEA), the U.N.'s atomic body. More than 65 additional states, newcomers to the technology, are jostling for advice on nuclear power.

Completion of Finland's new 1,600 megawatt reactor, built by French energy giant Areva and designed to withstand a plane crashing into it, is running four years late and will turn out far more expensive than its original 3 billion euro price tag. Areva alone has already taken 2.7 billion euros in writedowns on the project.

But delays and cost overruns are nothing compared to the skills crisis the project has helped expose, which is already affecting the nuclear sector around the world. "The global community is facing this big problem -- where is this human resource?" says Yanko Yanev, head of the IAEA's nuclear knowledge management unit, set up 10 years ago when the Vienna-based agency first sounded the alarm. "When we started this program, people said, 'Ah, give us a break!' Now they are realizing the problem is more complex than they had first thought."

PARALYSIS

Simply put, the cause of the looming shortage can be pinned on two events: Three Mile Island in 1979 and Chernobyl in 1986.

In its first few decades, full of optimism and hope, the nuclear age was run and staffed by workers who had graduated between the early 1940s and late 1960s. People like Esa Mannola, who is responsible for nuclear safety at Olkiluoto. Mannola studied technical physics in the late 1960s and after a brief stint of military service, took a job working on the first two nuclear units based on Olkiluoto, which went online in 1979 and 1982. Like about 40 percent of TVO's staff, Mannola, 62, is over 50.

"Nuclear was a brand new technology and it was exciting," he says, sitting in a bright conference room not far from where enormous parts for the reactor have been shipped in and hauled into place. "I felt it would be important for the country's future."

Now head of a specialist team of around 20 people at TVO, the wry, softly spoken manager says he is always on the lookout for potential new hires, but has struggled at times to find young people to fill highly specialized roles.

That's not surprising. After Long Island and Chernobyl, many countries put their nuclear plans on ice or even phased out nuclear altogether, moving instead to more affordable fossil fuels. Students turned away from the nuclear sector, recruitment stagnated and many workers left. "Nuclear did not create a permanent demand on the market so that people could see it as a prospective career," IAEA's Yanev says.

The malaise lasted for well over a decade and created what Jorma Aurela, 51, chief engineer in Finland's energy department, calls a 'lost generation.' "Many of us were paralyzed. The people in this generation did not have a good future in front of them," says Aurela, who graduated just before the Chernobyl accident and as a young worker, used to occasionally tell people he was studying history because he was embarrassed to be associated with nuclear power. Around half his classmates quit the sector, he estimates. "Some have been found again but some are lost," he says. "They are lost to other parts of the industry or are mentally lost -- they do not want to work for this industry again."

That's left older workers running Finland's plants, and could threaten the country's planned nuclear growth, especially as Helsinki has just okayed plans for two more new plants.

SILVER TSUNAMI

It's a similar story in other parts of the Western world. French utility EDF says around 50 percent of employees in its nuclear branch will retire by 2015 and that its workers are on average 43-44 years old.

In the United States, the peak age of workers in the nuclear sector is 48-52 while Britain estimates that up to two-thirds of its top-tier nuclear managers will retire by 2025. Worldwide, the nuclear industry employs around 250,000 people. Many first-generation nuclear staff have just retired or will do so in the next few years, taking with them skills and knowledge of complex, costly projects -- just as the nuclear renaissance gets underway.

Sometimes referred to as a "silver tsunami," the departure of the first generation of nuclear workers is a big concern for the IAEA, which promotes civilian nuclear technology alongside its role as atomic watchdog. Many countries and private firms have new units planned or under construction, the agency said in a September report for a conference of its 151 member states. "(They) are facing shortages of experienced personnel and loss of knowledge as they look to replace retiring staff for their existing fleet while at the same time staffing new projects."

Finnish nuclear regulator Stuk says the lack of skilled workers is at least partly to blame for the delays at Olkiluoto. So many experienced nuclear manufacturers have left the business that project managers have been forced to look for subcontractors who then need nuclear training, the regulator said in a presentation in August. Building the next generation of power plants will be demanding, "because much of the earlier experience and resources have been lost from the nuclear industry."

And it's not just a lack of engineers. The global shortage runs from uranium miners to the waste-disposal experts who tidy up at the end of the nuclear cycle. "I've got colleagues running around Florida trying to find people to take their knowledge before they die," says Peter Waggitt, a uranium production consultant to the IAEA. "Most of the senior experts in uranium mining are pushing 50 and some of the best are over 70."

A fall in uranium prices in the late 1980s left scant incentive to enter the mining industry, while leaky, badly constructed mines gave uranium mining a bad name. But the ore is now trading at around $60 per pound, in real terms more than four times the 1990 price. More than 500 companies are involved in the sector and the IAEA says at least 30 new uranium mines will open before 2015. The workforce, says Waggitt, is struggling to keep pace.

In May 2008, BHP-Billiton said it would take longer than originally estimated to expand its Olympic Dam copper-uranium mine in Australia because the worldwide mining boom had created greater competition among skilled workers, higher prices and shortages of equipment. A skills shortage still hangs over the site, the world's biggest uranium deposit. The Australian government has estimated the country needs around 6,000 extra skilled workers during construction. Analysts have put the full expansion cost at $20 billion or more. Waggitt sees these problems as a warning to the wider industry: "Uranium mining is at the very beginning. If there is a problem in this sector it is a problem for the entire nuclear cycle."

BURNING NEED

In an attempt to tackle the shortfall, Finland is rushing out a blueprint that outlines how to get more young people studying nuclear energy. From his offices next to the presidential palace in Helsinki, chief engineer Aurela heads a 20-person committee which is assessing the needs of Finland's future nuclear workforce. The country wants to build another large plant at Olkiluoto by 2020. To staff such grand plans, Aurela says Finland will need to produce at least 100 nuclear specialists a year. At the moment it produces just 20 to 30.

After talks with industry, university and government officials, the committee will soon present a detailed report on what to do next. "It will come out in spring," Aurela says. "We don't have time for a year. We need to get the measures in place. We know some of them already -- we only have two nuclear physics professors in Finland and we already know that that is too few."

One of those professors is Rainer Salomaa, who first got into nuclear as a way to escape the isolated southwestern port city of Turku where he grew up, 160 km (99 miles) from where he now teaches near the capital. Producing the next generation of nuclear experts, says Salomaa, 62, should not be left to chance.

"With the development at Olkiluoto, people are much more excited," he says, sitting in his Aalto University office with its stacks of curled papers and heavy text books. "But when you are training new people, just to get an ordinary professional it takes around five years. It's a very slow process -- and to get a professor it takes 15 years -- that's one of the bottlenecks."

Student numbers in basic nuclear engineering at the university have gone up, to around 30 a year from about 12 in 2000, the low-point of the industry in Finland. Masters students in the field -- who it is hoped will become the next generation of top-notch nuclear specialists -- have risen to 6-10 per year from 2-3 a decade ago. That's an improvement, but nothing like what Salomaa says is needed. "For the moment we will survive, but once the two new units start at full speed the burning need will continue.

"The difficulty is that the number in the new generation anywhere is getting smaller. There's huge global competition for the bright students -- they are wanted in economics, law -- and engineering is not as fashionable as it used to be."

NEW BLOOD

Finding the right people to fill all those jobs will not be easy. Before padding in flipflops and socks to a lecture theater, Salomaa explains what he is looking for in a student. "The courage to tackle non-definable problems," he says. "With nuclear engineering, you really have to have the courage not to give up."

At the same time, he wants students with a deep respect for safety and rules. His generation was rattled by two major nuclear accidents and had safety taught to them like a mantra. "The safety culture is a question of attitude. It has to be there from the start."

Few people have that mix: mathematically gifted, able to think outside the box, but also happy to abide by rules. On a grey, mild day in late September, some 30 young Finns who have at least some of those attributes listen to a lecture in a boxy, functional building on Aalto University's sprawling science and technology campus. "I could work in the nuclear industry, I think it has a future," says Karita Kajanto, a 21-year-old energy technology student in crisp, word-perfect English.

Like her other classmates, though, Kajanto notes that some are not so upbeat about nuclear physics. "Here at this university people have positive views but some friends studying humanities -- and some people who don't really know about it -- they have quite aggressive views that what we are doing is wrong," she says. To give them choices after graduation, many of her classmates also take classes in the much trendier renewable energies such as solar and hydropower.

One problem is cultural. "The way nuclear companies are managed and the way young people want to work are different," Cap Gemini's Lewiner says. "Nuclear companies can be quite hierarchical, it is very controlled -- you are allowed to do this and not that. Some of that is needed of course, but it has to be softened."

Changing that image will take time -- but it is possible. A recent study by polling company Gallup showed nearly one third of young Finns are in favor of nuclear power, the highest since the survey began in 1982. Ten percent were against it and the rest were neutral.

FRENCH OPPORTUNITY

The country that has done the best job of promoting atomic power is France, which began its nuclear power program in the 1960s and now gets more than 75 percent of its electricity from nuclear. French firms, which have rounded up new employees at breakneck pace in the past half decade, say that drive combined with an increased involvement in training makes them less worried by potential staff shortages than they were in the mid-2000s. Areva, for instance, says that while it has recruited 53,000 people since 2005, the urgency has slowed: in part due to the economic crisis and in part because its needs are fairly well filled.

France even sees opportunity in others' problems. French universities have decided to teach some nuclear courses in English to prepare students for an international career and attract non-French speakers. "There has been renewed interest in training because of France's own needs and a worldwide nuclear rebirth," says Laurent Turpin, head of the Institute for Nuclear Sciences and Technology (INSTN) outside of Paris.

Several students, interestingly, said that having anti-nuclear parents pushed them to study the subject. "People around me were ecologists," said Olivier, a 24-year old masters student. "Because I questioned this complete refusal, I wanted to study nuclear by scientific pragmatism. I then realized it was a sector which had a future."

LUMPS OF MACHINERY

Rediscovering some of its original optimism and raising the industry's profile may help. "In some ways it has been kept pretty secret," says the IAEA's Yanev, 60, who became excited about nuclear power in his native Bulgaria as a teenager watching the space race in the 1960s. "It was definitely not explained properly to the public and it is complex. It is not so easy to understand the nuclear processes without the proper education."

Some governments have begun targeting female students and minorities. In Britain, where the government has plans for eight new nuclear plants to replace those due for closure over the next decade, the decommissioning authority has launched a drive to recruit young people.

"It was very much an image of a man in a white coat and a hard hat standing next to a big piece of machinery or a waste pond," says Carl Dawson, manager of Britain's nuclear graduate program which has taken in 35 people since it started in 2008. Dawson says the scheme focuses on students from different academic backgrounds who can then be "nuclearized" once on board.

One such graduate is 25-year-old Becky Read, who studied chemistry and biology at Birmingham University and met Dawson at a careers fair before she graduated two years ago. "Imagine, everyone else there had a little stall with brochures and his scheme had a massive silver inflatable igloo," she says. "The program sounded so different to everything else."

Now Read has done everything from assessing how nuclear buildings withstand earthquakes to explaining atomic waste storage to the public. She has been working in Vienna at the IAEA, learning about technical cooperation between member countries. Enthusiastic about the future of nuclear power, she nonetheless feels some in the industry could do more to pass on their knowledge to the new generation.

"Some people seem scared of change. They want things to stay the same. They might worry when they see some 'bright young spark' coming in," she says, sipping coffee on the flag-decked U.N. plaza in Vienna. "These are the people who built the reactors, so it feels like their baby."

REMOBILISE

Whatever efforts countries make, things might get even tougher. Some worry that China and India, which are rapidly expanding their nuclear power programs, could begin snapping up workers from Europe and North America.

More than two-thirds of reactors under construction worldwide are in Asia -- primarily in China, which is building more than 20 and has around 40 more planned. According to statistics collected by the IAEA, China needs 1,200 graduates in nuclear engineering and technology a year. Chinese statistics suggest overall enrolment is matching demand but that it is struggling to recruit graduates in specialized areas of nuclear chemistry and the atomic fuel cycle as well as top managers. Nuclear power plant managers in Asia have told the IAEA that their best engineers are often poached to work on new projects, underlining the demand. "The problem in China is that they have too many young people but not the older ones," the IAEA's Yanev says, referring to the nuclear workforce. "The expansion is so fast that they don't have the necessary experience."

Fierce competition for skilled workers might force companies to entice older workers out of retirement in the Western world. "The industry cannot only count on the fresh minds that will be trained. That is not possible, it takes too long. It takes four to five years for initial education and some time inside the company before they are operational," says Cap Gemini's Lewiner.

Hans-Holger Rogner, head of nuclear energy planning and economics studies at the IAEA, agrees, and says the industry cannot afford any age prejudice. When uranium prices went through the roof in 2007, companies "really went to the old people's homes and said, 'Well, you can sit in your armchair rocking back-and-forth or you can get back in the field at 75 years old.' I guess a similar thing will happen -- you bring back the old knowledge."

Rogner, 61, will leave the IAEA soon. Beginning his career in systems analysis after the oil price crisis in the 1970s, he says he plans to continue in the nuclear sector even if he officially retires.

"I am certainly not going to sit and twiddle my thumbs," he says. "There is a lot to do."

(Additional reporting by Muriel Boselli in Paris, Vera Eckert in Frankfurt, Daniel Fineren in London and James Regan in Sydney; editing by Simon Robinson and Sara Ledwith)

1234Green BusinessNatural Disasters

For the week: +15%... the whole sector is rushing upward.

Uptrend on the weekly is strong.

What a beautiful looking 6 week uptrend.

Still correcting against all the market fundamentals...

The overall uranium sector has been hurting while correcting in this uranium super bull.

Some signs of life in other cos.... watching closely.

Waiting for this industry to move again.

Weekly chart is just consolidating during the last couple months... the future is still bright.

Overall uptrend still seems to be intact... especially in the wekly chart.

Nobody has a crystal ball, however by looking at the weekly chart and the successive higher lows, one might reasonably conclude that around 2.60 to 2.70 might be a decent entry.

I am interested in playing the best across the board uranium play, and gur seems the way to go. What kind of entry price would be rasonable at this point

Yes, and a triple + off the 76 cent bottom... looks promising!

The weekly uptrend since Decenber is still intact...

An obvious battle is happening at the MA50...

MA50 about to cross the MA200 and then the fireworks should really fly!!!

A double is had by many that got the low under a buck...

This fund is blasting ahead along with the rest of the sector.

The bottom is probably at hand... the end of the week will tell us!

This may be the bottom... the PPS at the end of the year may confirm my observation...

|

Followers

|

0

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

43

|

|

Created

|

06/27/08

|

Type

|

Free

|

| Moderators | |||

Pure play portfolio of international uranium companies, comprised of producers, developers, and explorers.

http://www.bromptongroup.com/funds/gur/pdf/gur_summary.pdf

UBS Global Asset Management is one of the world's largest and most respected global asset managers. Total invested assets were approximately $635 billion as at June 30, 2009. UBS Global Asset Management truly has a global presence with over 3,500 employees located in 26 countries. UBS Global Asset Management (Canada) Co., a division of UBS Global Asset Management, is the portfolio manager for Global Uranium Fund Inc., which boasts a six member portfolio management team that draws upon the firm's breadth and expertise in global materials. The firm has a 25-year track record of providing superior performance for its clients by applying an intrinsic valuation methodology through an integrated global approach.

UBS Global Asset Management, one the world's largest and most respected global asset managers with over $838 billion in assets under management globally.

- 25 year track record of exceptional performance.

- Portfolio management team is comprised of nine global materials specialists with an average of 14 years investment management experience.

Supply/demand gap is expected to benefit uranium producers, developers and exploration companies as valuable long-term contracts are being negotiated at historically high prices.

http://www.bromptongroup.com/funds/gur/pdf/Uranium_fundamentals.pdf

3-year term ending June 30, 2010. Exercisable at any time prior to expiry at $10.25 for an additional equity share. One warrant issued per two equity shares outstanding.

Managed by Brompton Funds Management Limited, a member of the Brompton Group of Companies

1.10% per annum of the NAV (includes Manager's and Portfolio Manager's fees).

Uranium links from LinksMine - InfoMine's Library of Mining Web Sites Site Listings

Associations

Exploration

Investment Uranium Will Rebound with Economy - (The Energy Report) Interview with Barbara Thomae, Senior Mining Analyst Mines

Publications

Please boardmark us if this i-Message is helpful... Thanks in advance!!! |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |