| Followers | 1206 |

| Posts | 19160 |

| Boards Moderated | 0 |

| Alias Born | 01/15/2001 |

Tuesday, January 02, 2007 11:42:38 AM

Stocks That Make Kool-Aid Status: How Popular is my Stock?

By Bill Panetta

President of Breakout Trading

www.breakoutrading.net

That ghost of Jim Jones works in mysterious ways on the OTC BB and Pink Sheets Exchanges. There’s a special type of ‘Kool-Aid’ drink that traders and investors enjoy when trading small cap stocks, and this article will give you some insight into how to identify and protect yourself from sucking in too much of the red stuff. Let me stress, this article is not to degrade or put down traders or investors for buying these type stocks at all (I make good money on these type of plays all the time), we’re merely looking to get better at selling rather than hanging on and taking a positive trade that turns into a losing situation.

We have all invested or traded some big name penny stocks in our trading career. We all know the type of stocks that I'm talking about. We’re going to try to make some sense of when to sell these types of stocks.

In this article we are going to look at the Psychology (Message Boards) combined with Technical Analysis. (Charts). The Psychology part of trading is very important to my success as a full-time trader. A big motivation for me in writing this article is I have seen plenty of good buy-side traders, some of them close friends, make great buying decisions and then have no idea or clue when to sell a stock that they have nice profits in. The investors and traders that we are talking about had tons of profits in these stocks. What were going to try to accomplish today is getting better at taking profits, especially on KOOL AID (cult) Stocks.

Kool Aid Stocks have stories that claim will revolutionize the world. You have heard them before, Cures for Cancer. Billions in Diamonds. A blimp that was supposed to revolutionize Wireless Communications. Big contracts with Circuit City. Recently a CEO that claimed his penny stock was worth upwards of $50/share. When these types of stocks get mainstream exposure, they suck in novice investors what I call the 9-5 crowd and the frenzy begins. Now friends and relatives are in. The message boards are packed, with multiple posts per minute. Everyone is going to hit it big. Any detractors of the company are considered ‘bashers’ or believed to be ‘illegally short’ the company. They get banned, insulted, and attacked in groups. It can get pretty ugly. As the stock continues higher, the 9-5 crowd is hooked and now looking for that ‘retirement’ profit. They have no trading experience nor do they understand what Mass Psychology (Message Board Hype) , is or what to look for on the technical side (Charts). The fortunate part is that some of these people get lucky enough to make some money, but then, almost inevitably, the GREED kicks they drink the KOOL AID and something mysterious happens, there dream investments starts to go south.

Let’s see if we can figure out a way to find a top in a very popular stock using both MASS PSYCHOLOGY (Message Boards) and a very basic technical indicator like the MACD (Moving Average Convergence Divergence)

Let’s look at the MASS PSYCHOLOGY (Message Boards) first.

NOISE LEVEL: An indicator that I really like is a feature over at Investors Hub that gives me some really nice clues on stocks that have reached KOOL AID Status and could be nearing a top. Remember were looking for clues. One of the easiest ways to find out what the noise level is of a stock all one has to do is go to IHUB and click on the hot button http://investorshub.com/boards/most_read.asp and start looking at stocks that are the most read. Notice I specifically said most read (not the top boards or most posted). Not everyone posts. In fact, most people are just content to sit and read. The more people ‘lurking’ around a board show the larger audience the stock has. Browse a few of the most read posts and look for ‘cult-like’ activity. More than likely, you’ll see multiple posts giving the company glowing reviews. You might even catch a price target or two, well in excess of any reasonable share appreciation. It all sounds great, but what a lot of the people posting do not realize is that they all could very quickly become long-term shareholders in a go-nowhere company. You want to carefully time heavy ‘noise’ companies with those that are on a clear and sustainable uptrend, otherwise it’s akin to being sucked into a black hole.

Most of the stocks that you will see on this list are what I call broken stocks. Cult stocks that have gone bad. As you look at this list of companies especially in the top 5 most of these stocks have the biggest stuck holder bases on OTC & Pinks. You have to sell aggressively as your stock climbs into the top 5. Again this exercise is part of topping process of a stock. So check and monitor the list on regular basis to see what your stock is doing.

TECHNICAL ANALYSIS:

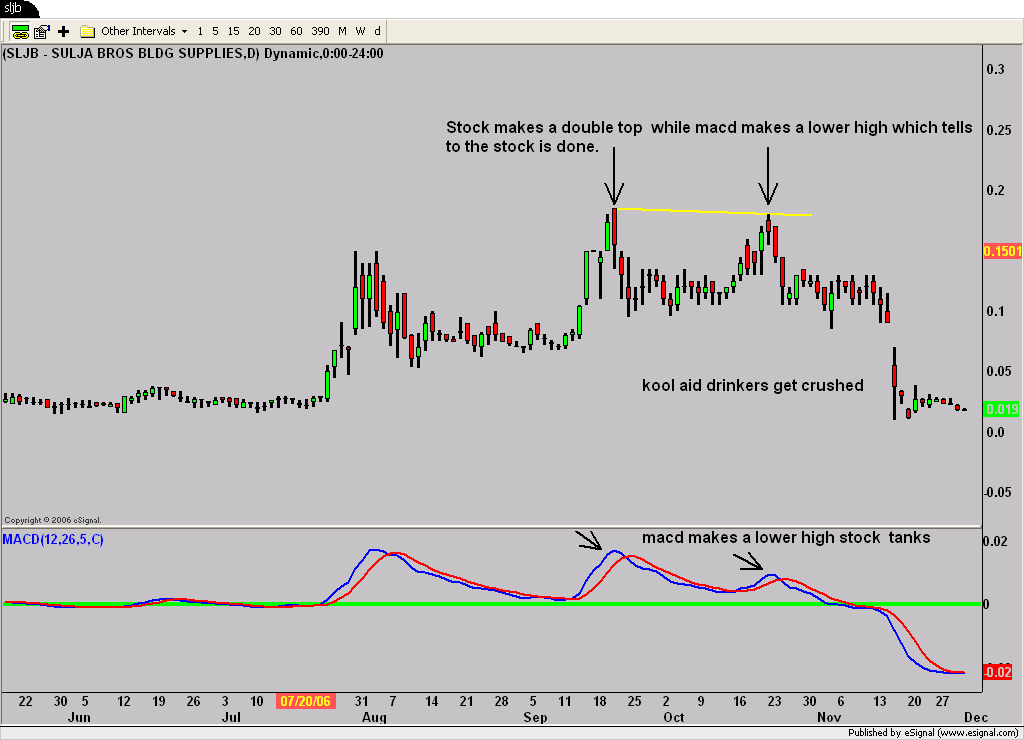

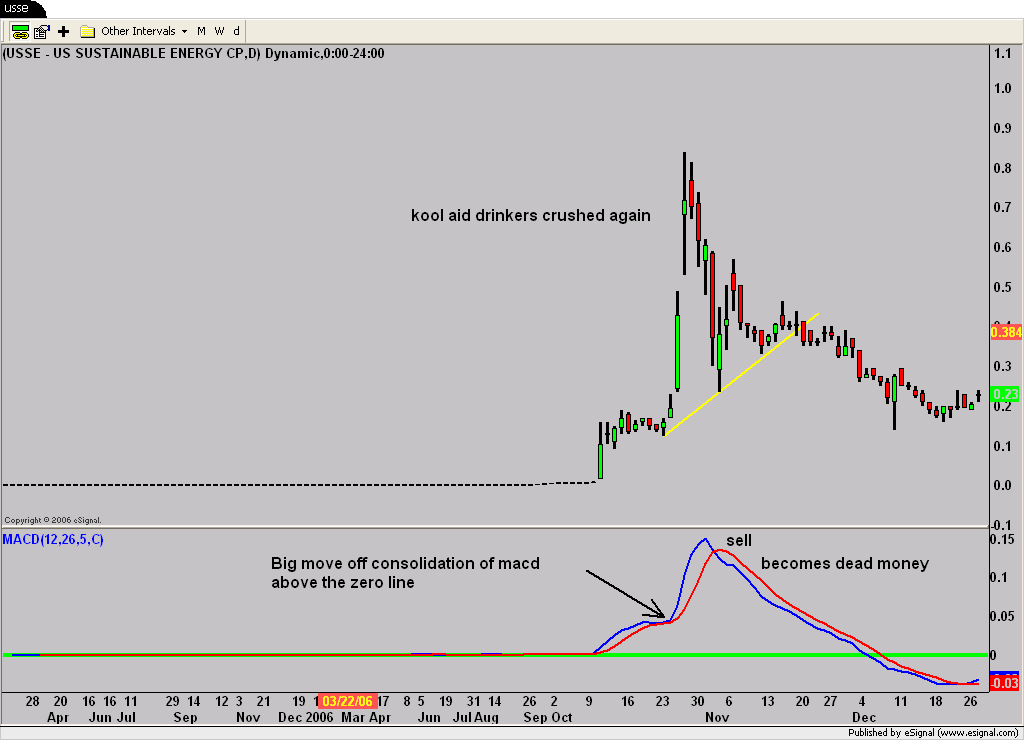

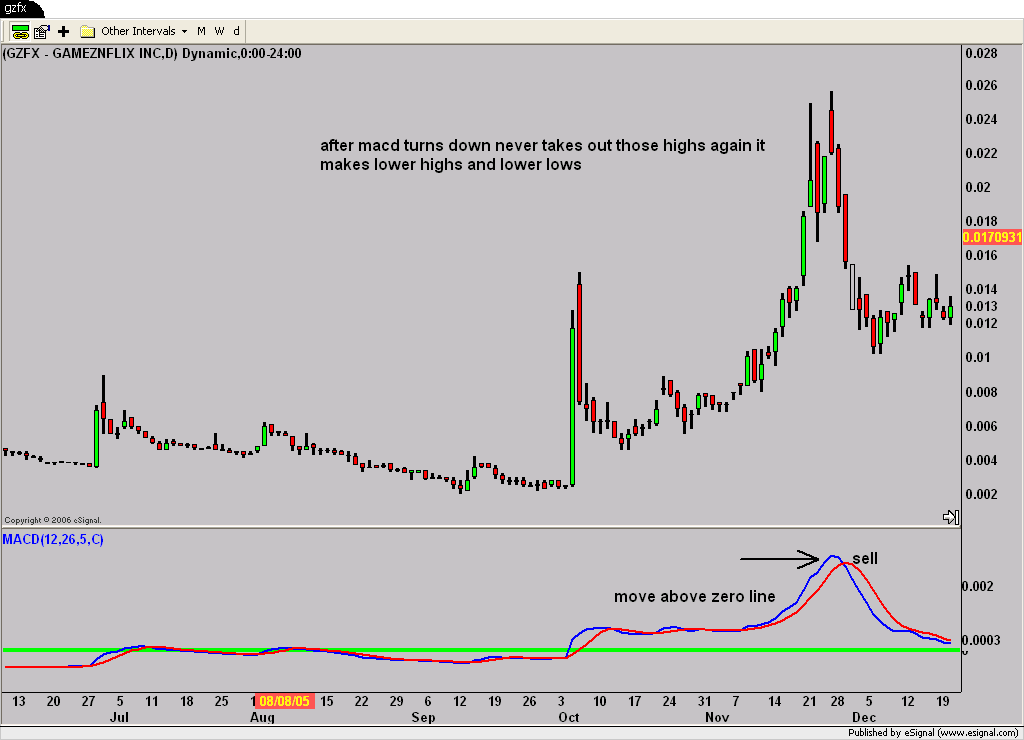

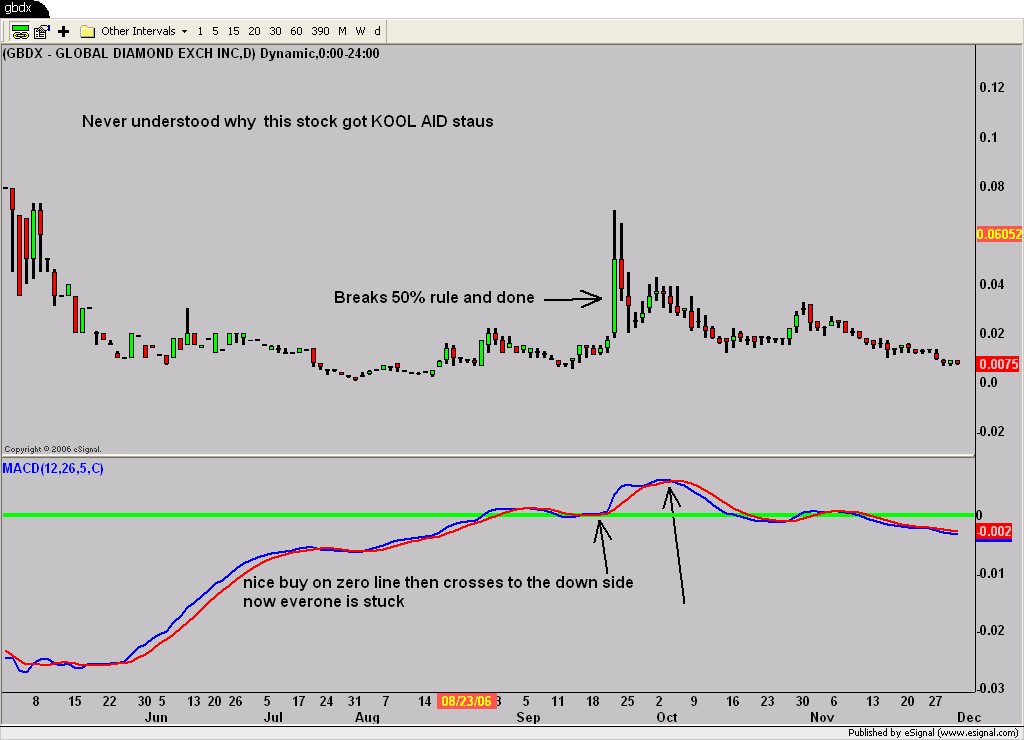

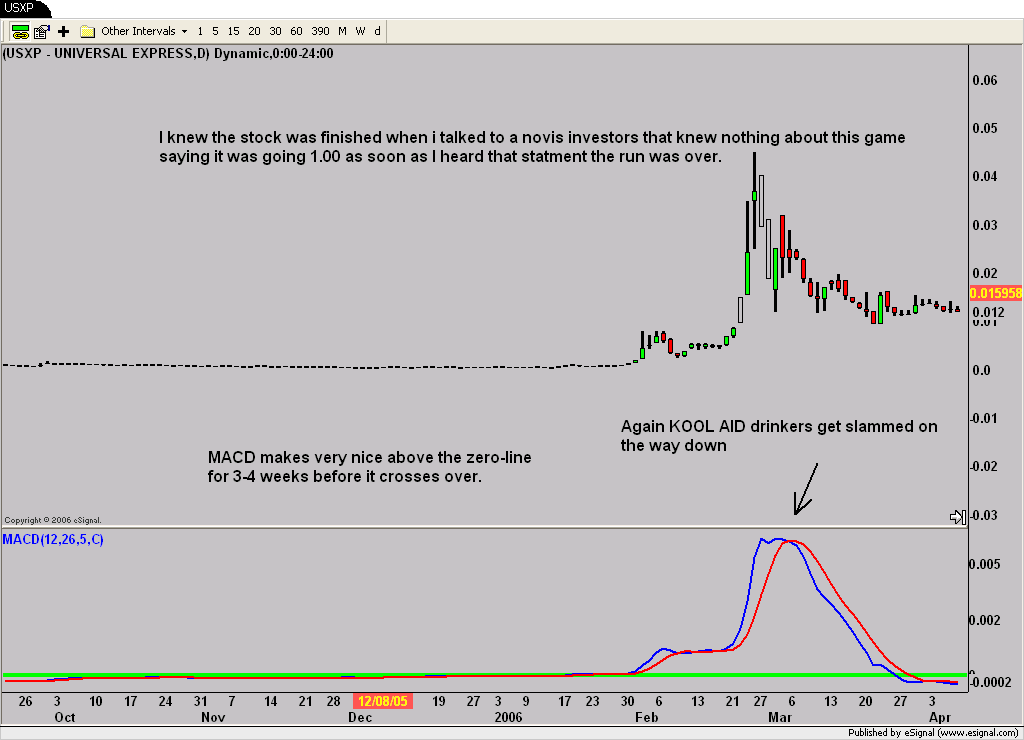

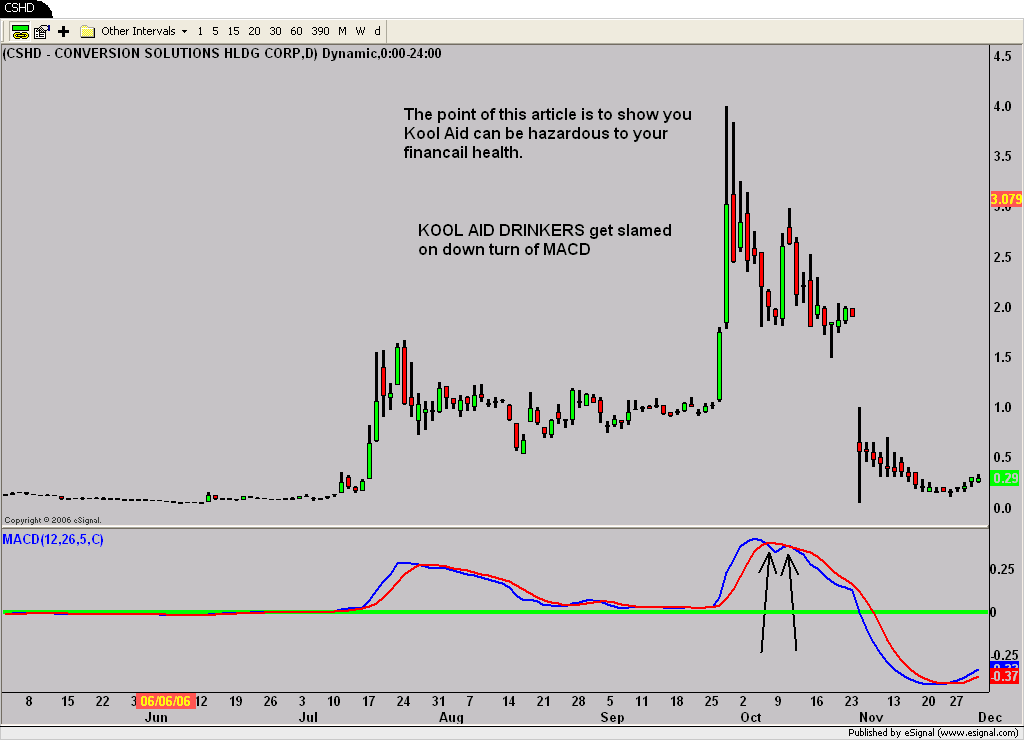

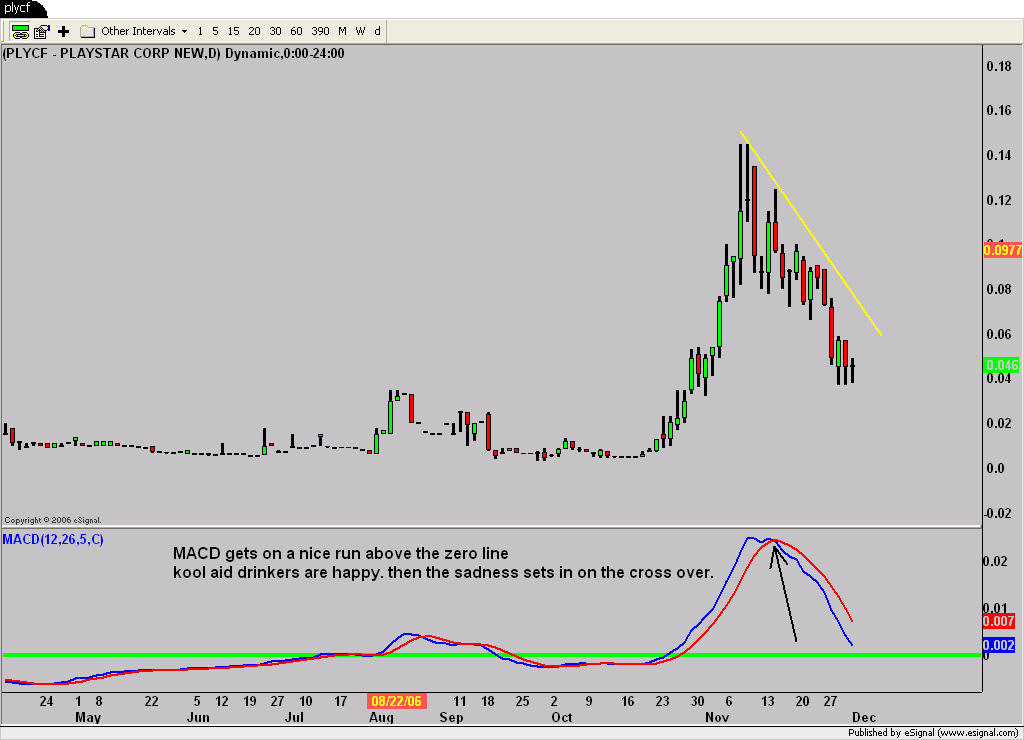

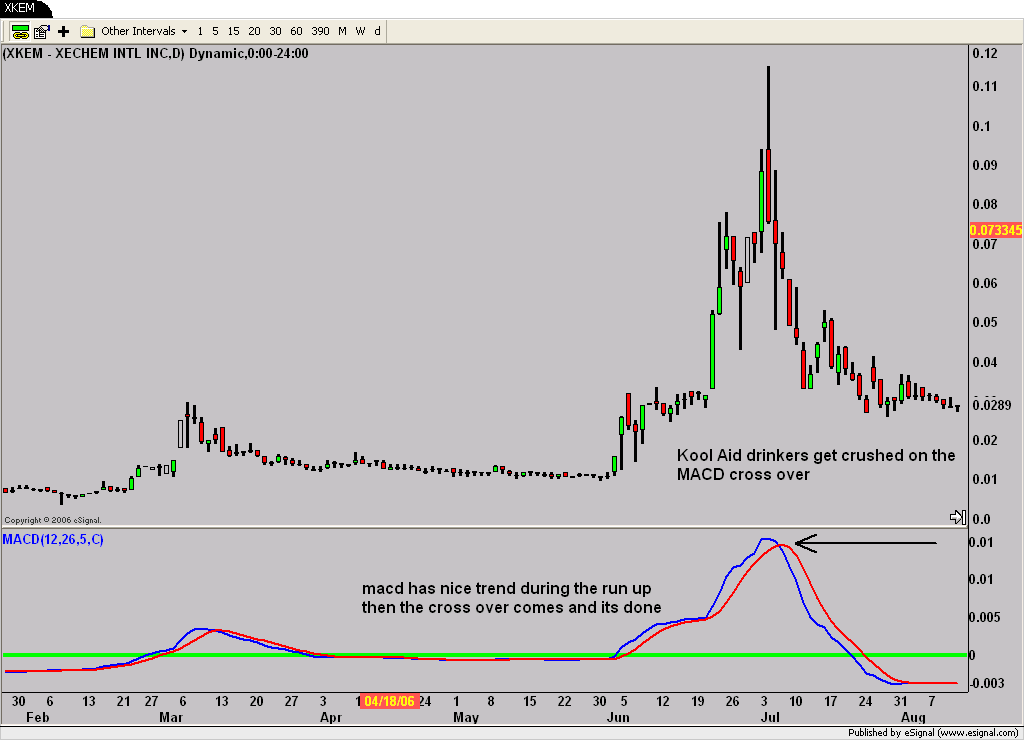

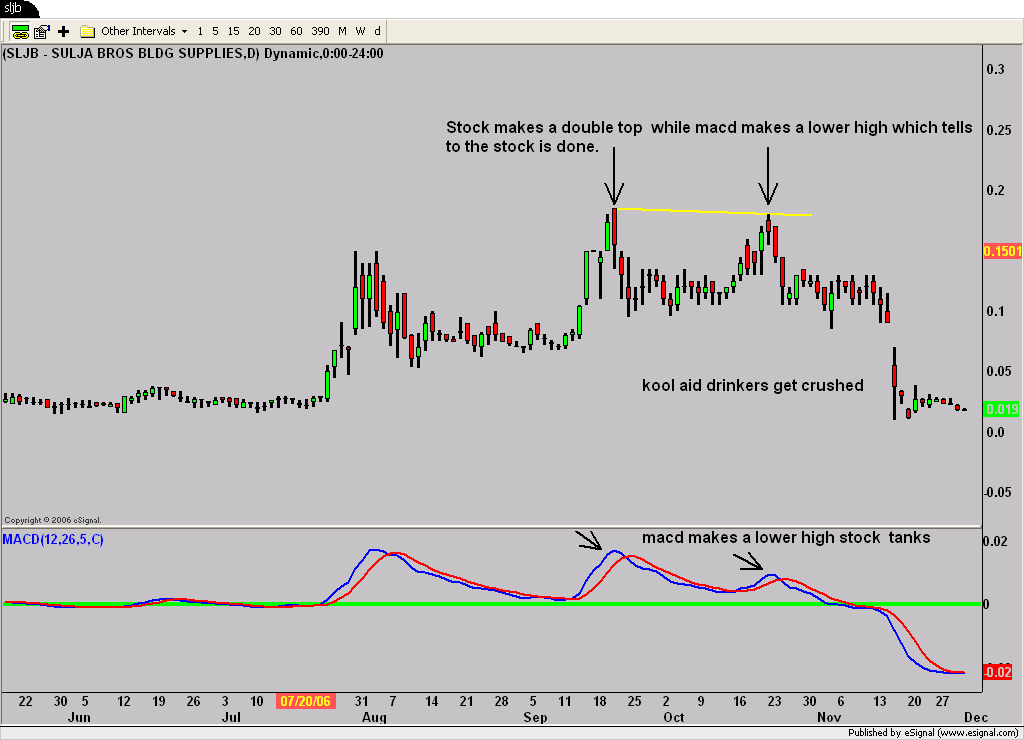

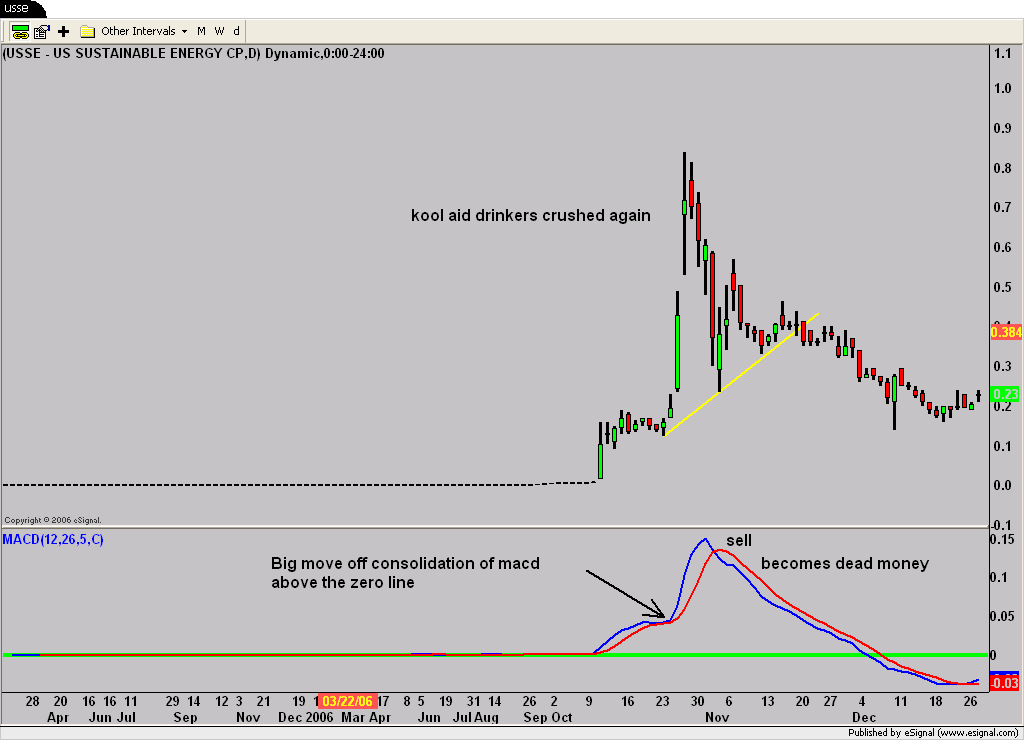

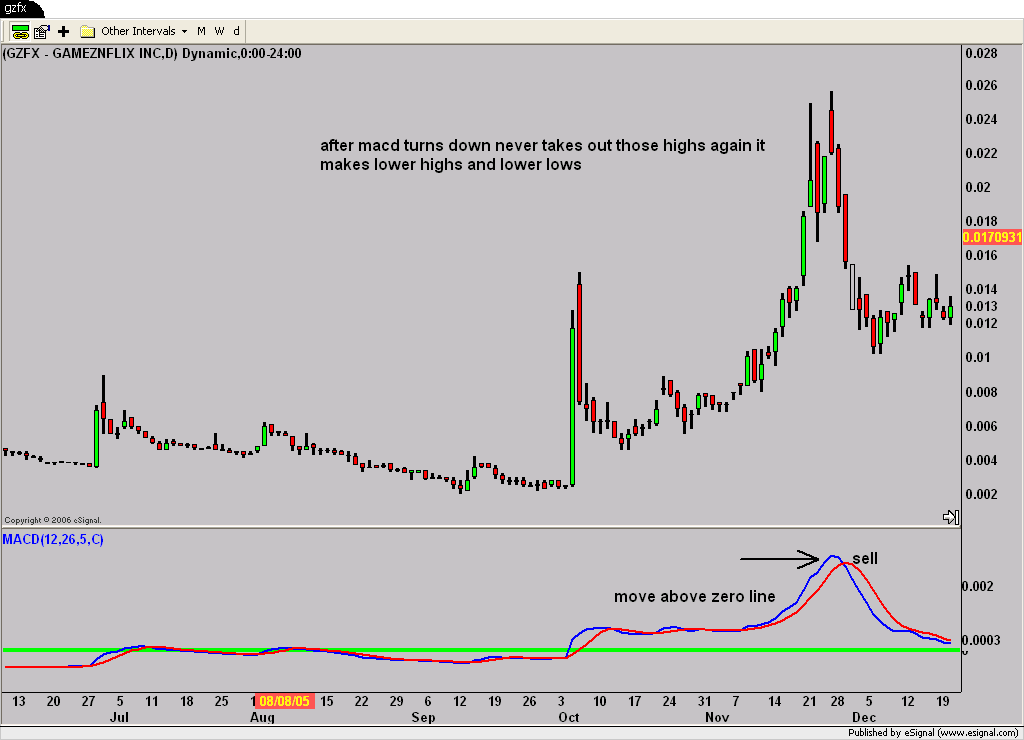

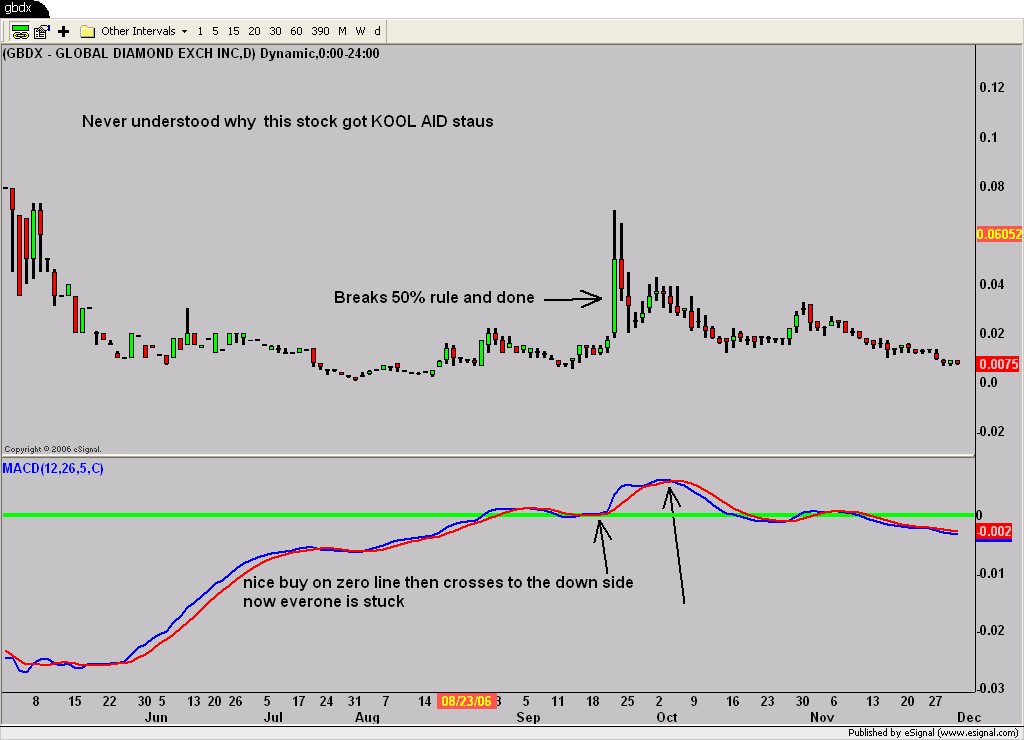

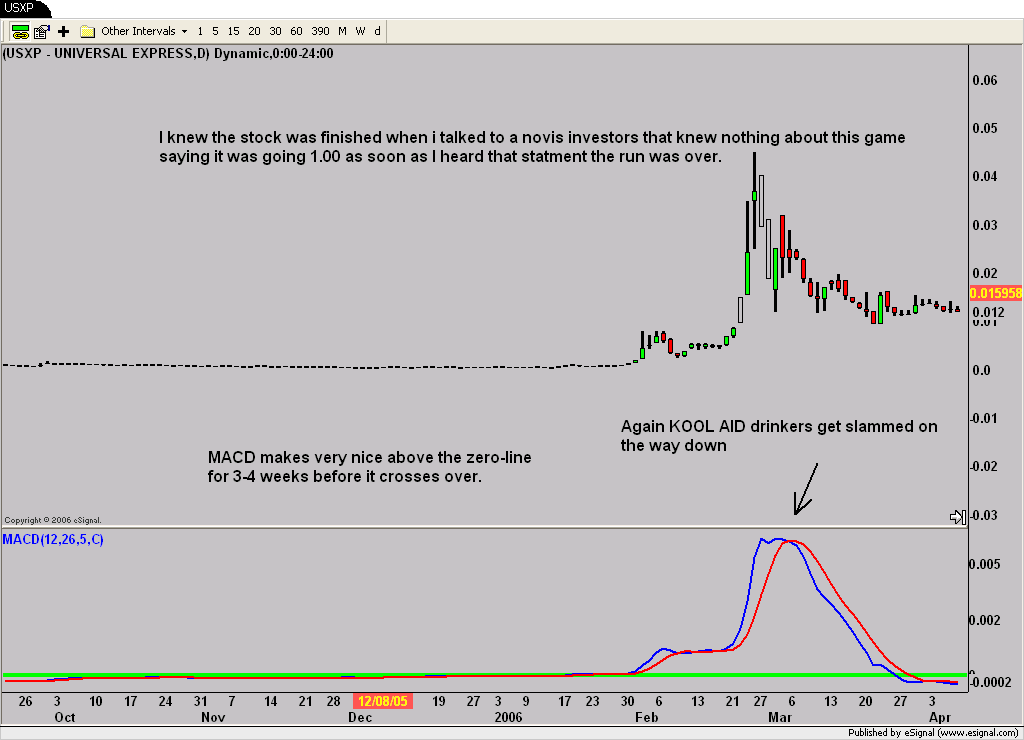

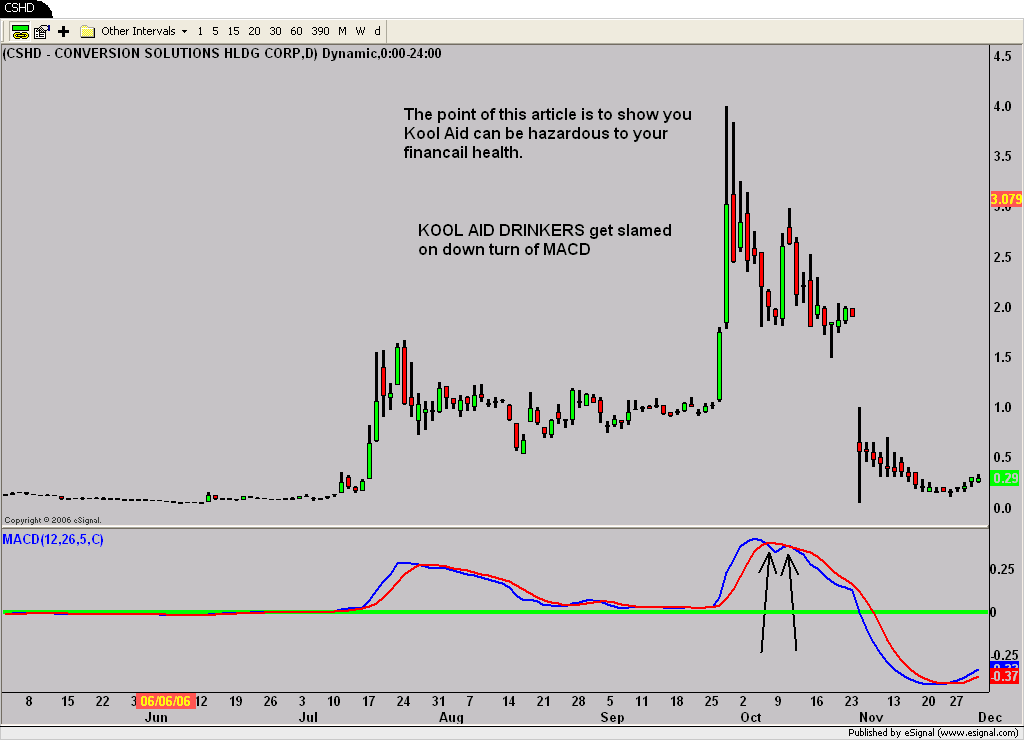

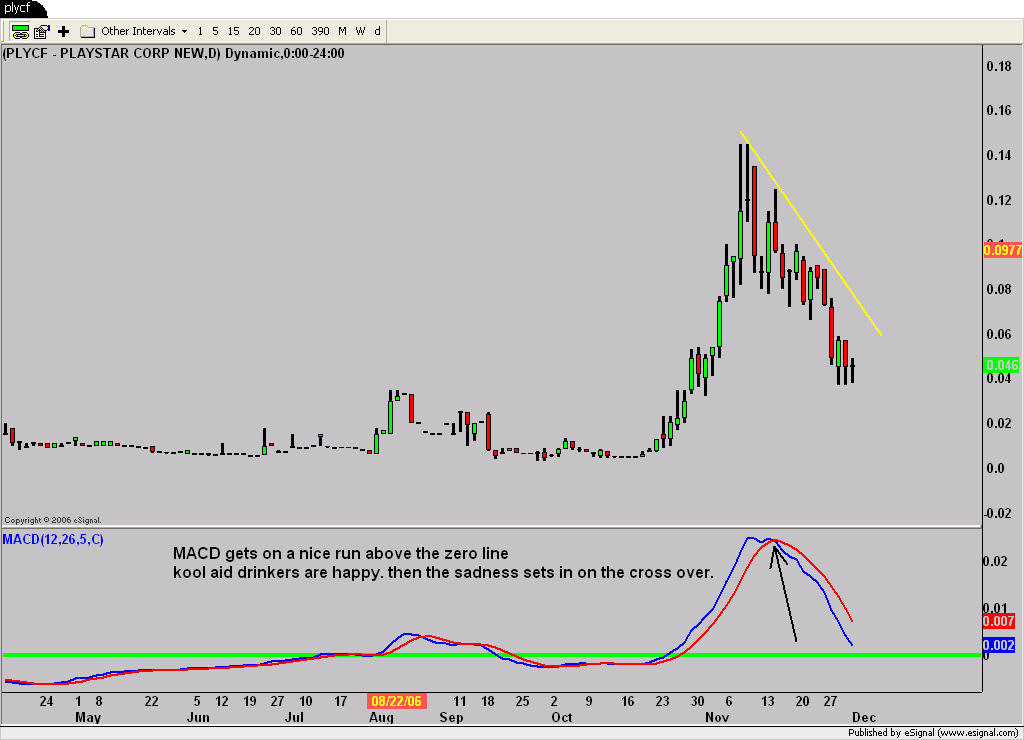

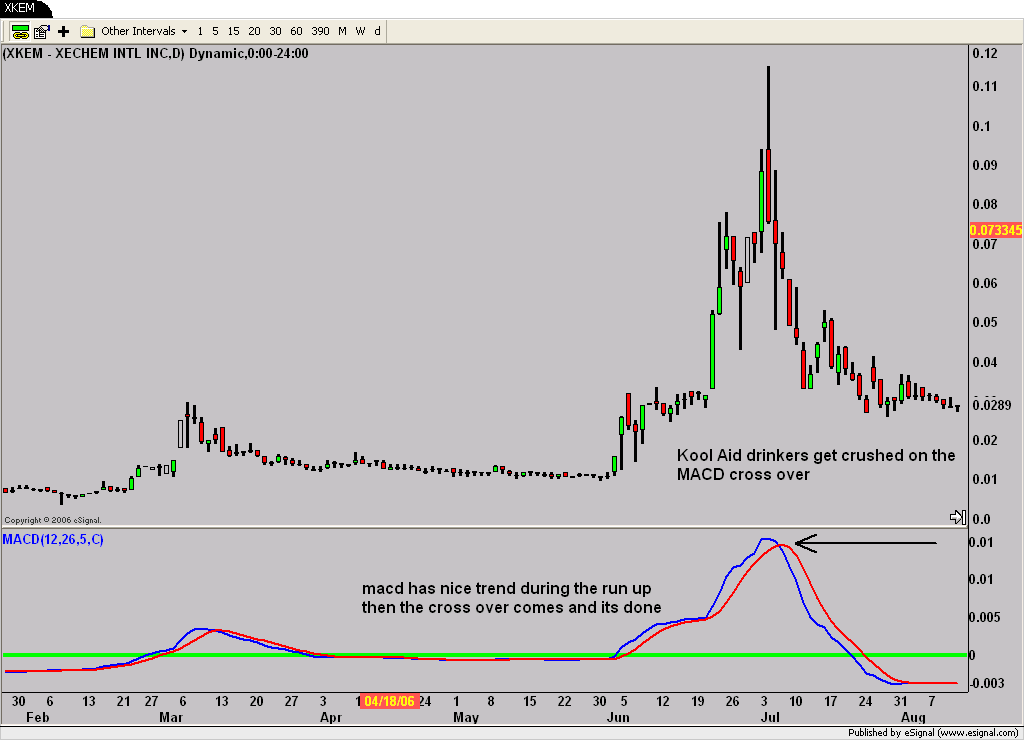

MACD: Lets talk about the MACD indicator. The MACD is one of my favorite indicators because it identifies the trend and the strength of the trend. We’re looking for a stock that crosses above the zero-line on the MACD, which can create a powerful move that can last weeks at a time. You want to see some sense of direction in this indicator. Although there are plenty of stocks that are ‘bottomed out’ as far as MACD is concerned, without any indication of a reversal, you could be waiting for months for a move higher. To illustrate this, I’ve included some stocks that gave us some pretty convincing warning signals as far as MACD is concerned. Let’s look at some charts and see if any of this makes any sense.

As you can see, using mass psychology (message boards) combined with a simply technical indicator like MACD can help you avoiding drinking some very expensive Kool-Aid. This methodology is not an end-all to trading, but should serve as a good general reference for you to be more successful in some of the heavily-touted stocks.

Quick Note: The MACD should be used on any stock you are trading – not just cult stocks.

MONEY MANAGEMENT: I see a lot traders and investors giving back profits from the riding of free shares on these ‘Kook-Aid’ stocks. Some traders and investors think because they bought the stock DIRT at .003 and sold ½ their shares at .01, the trade is over its time to relax. While selling a portion of your stock every time the stock climbs 50% or 100% is good practice, it’s very important to still watch and be responsible for the remaining ‘free’ shares. Many traders begin to ignore technical analysis after creating ‘free’ shares, often ignoring critical MACD downturns. When you sold DIRT .at .01, the MACD may have been over the zero line, positive, and still heading up. If the stock continued higher, you may have an exceptional profit and be tempted to just keep ‘letting it ride’. Unfortunately, being complacent about the MACD could cost you big bucks. Even with ‘free’ shares, there’s a tremendous difference between selling at .15 and selling at 03. While you would not ‘lose’ in the true sense of the word, you could miss an opportunity to make exponentially more money simply because you failed to pay attention to a basic indicator. Do not rationalize that ‘free’ shares do not matter into your trading strategy and surmise to hold them forever. Treat them like any other trade and protect your profits when you have them. It could have meant an extra $500, $5,000, or $50,000 to your pocket, and that’s nothing any of us can afford to write off. The bottom line is this, if the MACD turns down, get aggressive in taking profits. There are a slew of potential sellers – convertible holders, CEOs, restricted holders that are freed up, market markers, and other retail players. If you let your guard down, you will eventually give back all of your entire ‘free’ shares. Let this be clear, as far as trading and money management goes, there is no nobility in giving back profits.

In summary , buying into a stock is easy, selling and knowing when the top is coming into any stock is the hard part. The very basic principals in this article should help you get better and selling for nice profits.

Lets get better at taking profits in 2007

Bill Panetta

www.breakoutrading.net

Special thanks to Tim at www.pqlresearch.com

cshd sljb usxp xkem erhe pypr bkmp neom idcc usse smmw ckys mgmx pbls dnag ibcx nwog eqbm hmgp bcit rsmi hisc ipkl dkam

pphm fccn amep hrct dpdw cmkx qbid

By Bill Panetta

President of Breakout Trading

www.breakoutrading.net

That ghost of Jim Jones works in mysterious ways on the OTC BB and Pink Sheets Exchanges. There’s a special type of ‘Kool-Aid’ drink that traders and investors enjoy when trading small cap stocks, and this article will give you some insight into how to identify and protect yourself from sucking in too much of the red stuff. Let me stress, this article is not to degrade or put down traders or investors for buying these type stocks at all (I make good money on these type of plays all the time), we’re merely looking to get better at selling rather than hanging on and taking a positive trade that turns into a losing situation.

We have all invested or traded some big name penny stocks in our trading career. We all know the type of stocks that I'm talking about. We’re going to try to make some sense of when to sell these types of stocks.

In this article we are going to look at the Psychology (Message Boards) combined with Technical Analysis. (Charts). The Psychology part of trading is very important to my success as a full-time trader. A big motivation for me in writing this article is I have seen plenty of good buy-side traders, some of them close friends, make great buying decisions and then have no idea or clue when to sell a stock that they have nice profits in. The investors and traders that we are talking about had tons of profits in these stocks. What were going to try to accomplish today is getting better at taking profits, especially on KOOL AID (cult) Stocks.

Kool Aid Stocks have stories that claim will revolutionize the world. You have heard them before, Cures for Cancer. Billions in Diamonds. A blimp that was supposed to revolutionize Wireless Communications. Big contracts with Circuit City. Recently a CEO that claimed his penny stock was worth upwards of $50/share. When these types of stocks get mainstream exposure, they suck in novice investors what I call the 9-5 crowd and the frenzy begins. Now friends and relatives are in. The message boards are packed, with multiple posts per minute. Everyone is going to hit it big. Any detractors of the company are considered ‘bashers’ or believed to be ‘illegally short’ the company. They get banned, insulted, and attacked in groups. It can get pretty ugly. As the stock continues higher, the 9-5 crowd is hooked and now looking for that ‘retirement’ profit. They have no trading experience nor do they understand what Mass Psychology (Message Board Hype) , is or what to look for on the technical side (Charts). The fortunate part is that some of these people get lucky enough to make some money, but then, almost inevitably, the GREED kicks they drink the KOOL AID and something mysterious happens, there dream investments starts to go south.

Let’s see if we can figure out a way to find a top in a very popular stock using both MASS PSYCHOLOGY (Message Boards) and a very basic technical indicator like the MACD (Moving Average Convergence Divergence)

Let’s look at the MASS PSYCHOLOGY (Message Boards) first.

NOISE LEVEL: An indicator that I really like is a feature over at Investors Hub that gives me some really nice clues on stocks that have reached KOOL AID Status and could be nearing a top. Remember were looking for clues. One of the easiest ways to find out what the noise level is of a stock all one has to do is go to IHUB and click on the hot button http://investorshub.com/boards/most_read.asp and start looking at stocks that are the most read. Notice I specifically said most read (not the top boards or most posted). Not everyone posts. In fact, most people are just content to sit and read. The more people ‘lurking’ around a board show the larger audience the stock has. Browse a few of the most read posts and look for ‘cult-like’ activity. More than likely, you’ll see multiple posts giving the company glowing reviews. You might even catch a price target or two, well in excess of any reasonable share appreciation. It all sounds great, but what a lot of the people posting do not realize is that they all could very quickly become long-term shareholders in a go-nowhere company. You want to carefully time heavy ‘noise’ companies with those that are on a clear and sustainable uptrend, otherwise it’s akin to being sucked into a black hole.

Most of the stocks that you will see on this list are what I call broken stocks. Cult stocks that have gone bad. As you look at this list of companies especially in the top 5 most of these stocks have the biggest stuck holder bases on OTC & Pinks. You have to sell aggressively as your stock climbs into the top 5. Again this exercise is part of topping process of a stock. So check and monitor the list on regular basis to see what your stock is doing.

TECHNICAL ANALYSIS:

MACD: Lets talk about the MACD indicator. The MACD is one of my favorite indicators because it identifies the trend and the strength of the trend. We’re looking for a stock that crosses above the zero-line on the MACD, which can create a powerful move that can last weeks at a time. You want to see some sense of direction in this indicator. Although there are plenty of stocks that are ‘bottomed out’ as far as MACD is concerned, without any indication of a reversal, you could be waiting for months for a move higher. To illustrate this, I’ve included some stocks that gave us some pretty convincing warning signals as far as MACD is concerned. Let’s look at some charts and see if any of this makes any sense.

As you can see, using mass psychology (message boards) combined with a simply technical indicator like MACD can help you avoiding drinking some very expensive Kool-Aid. This methodology is not an end-all to trading, but should serve as a good general reference for you to be more successful in some of the heavily-touted stocks.

Quick Note: The MACD should be used on any stock you are trading – not just cult stocks.

MONEY MANAGEMENT: I see a lot traders and investors giving back profits from the riding of free shares on these ‘Kook-Aid’ stocks. Some traders and investors think because they bought the stock DIRT at .003 and sold ½ their shares at .01, the trade is over its time to relax. While selling a portion of your stock every time the stock climbs 50% or 100% is good practice, it’s very important to still watch and be responsible for the remaining ‘free’ shares. Many traders begin to ignore technical analysis after creating ‘free’ shares, often ignoring critical MACD downturns. When you sold DIRT .at .01, the MACD may have been over the zero line, positive, and still heading up. If the stock continued higher, you may have an exceptional profit and be tempted to just keep ‘letting it ride’. Unfortunately, being complacent about the MACD could cost you big bucks. Even with ‘free’ shares, there’s a tremendous difference between selling at .15 and selling at 03. While you would not ‘lose’ in the true sense of the word, you could miss an opportunity to make exponentially more money simply because you failed to pay attention to a basic indicator. Do not rationalize that ‘free’ shares do not matter into your trading strategy and surmise to hold them forever. Treat them like any other trade and protect your profits when you have them. It could have meant an extra $500, $5,000, or $50,000 to your pocket, and that’s nothing any of us can afford to write off. The bottom line is this, if the MACD turns down, get aggressive in taking profits. There are a slew of potential sellers – convertible holders, CEOs, restricted holders that are freed up, market markers, and other retail players. If you let your guard down, you will eventually give back all of your entire ‘free’ shares. Let this be clear, as far as trading and money management goes, there is no nobility in giving back profits.

In summary , buying into a stock is easy, selling and knowing when the top is coming into any stock is the hard part. The very basic principals in this article should help you get better and selling for nice profits.

Lets get better at taking profits in 2007

Bill Panetta

www.breakoutrading.net

Special thanks to Tim at www.pqlresearch.com

cshd sljb usxp xkem erhe pypr bkmp neom idcc usse smmw ckys mgmx pbls dnag ibcx nwog eqbm hmgp bcit rsmi hisc ipkl dkam

pphm fccn amep hrct dpdw cmkx qbid

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.